Big Loss from China Snowball

As a result of underperformance in the China and Hong Kong stock markets, Chinese investors have been hit by significant losses in ‘Snowball’ derivatives. What is Snowball, and how does it work?

Snowball is a structural derivative tied to the performance of an underlying index. It offers coupons as long as that index stays within a predetermined range. This product is commonly used in the Chinese market, specifically tied to CSI 500 or CSI 1000 (which have higher volatility than CSI 300).

How does Snowball work?

If the index rises above the top of the range, it triggers a “knock-out,” terminating the contract, and investors receive coupons for that period. If the index drops below the bottom of the range, it triggers a “knock-in,” and holders receive no coupon, potentially losing part of their capital.

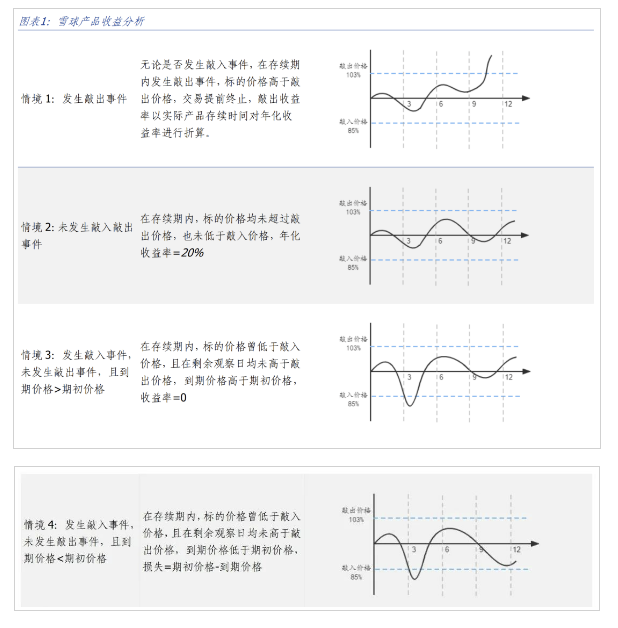

Let’s delve into the details of how to profit or incur losses with Snowball:

Gain: During the contract time, if the index price is above the top range, the contract terminates immediately, and investors receive coupons based on the period.

Gain: If the index price stays within the range throughout the whole period, investors receive the full coupons at the expiration date.

No Gain/Loss: If the index price falls below the bottom range price for once but is within the range at the expiration date, the investor’s gain/loss is zero.

Loss: If the index price falls below the bottom range price at the expiration date, the investor incurs a loss equal to the initial price minus the ending price.

How does the broker gain from Snowball?

Selling one Snowball product means buying a put option. Brokers use the Delta 0 strategy.

In the long put option, the delta would be small when the underlying asset has a higher price, requiring fewer assets for hedging. If the underlying asset has a lower price (put option has a higher price), the delta would be bigger, requiring more assets for hedge. Brokers buy more assets when the underlying asset price is low and sell high when the price is high (高抛低买).

For these brokers, they will gain profit within this dynamic market. If the underlying asset price increases, their profit is calculated as the underlying asset gain minus investor gain. If the underlying asset price decreases, the investor takes all the risk as brokers have no risk.

Normally, the “Knock-in” price would be 80-70% of the initial price, and the “Knock-out” price would be 103% of the initial price. Why is the percentage not the same?

Why is the Knock-out percentage so small?

To brokers, selling the Snowball product is equivalent to buying a put option. The key point is that if the “Knock-out” price is too high, it’s more likely that the investor would stay within the range, and brokers would need to pay more in coupons, which would not be beneficial for brokers to gain a profit.

Why is the Knock-in percentage so high?

When the underlying asset price that brokers hold is decreasing, the broker incurs a loss. However, since the broker sells the Snowball product (equivalent to buying the put option), the loss is offset. Also, a high knock-in percentage can give investors a sense of security, attracting them to invest.

Knock-in and knock-out observation time

Knock-in observation time would be every day: so it means that the broker would observe the price of the underlying asset to check whether the price is below the range.

Knock-out observation time would be once a month: so it means that the broker counts the knock-out only once a month.

Since the knock-out event is a loss for the broker, the broker would prefer to decrease the observation frequency. As the broker can gain profit from the “knock-in” event, the broker definitely traces the “knock-in” event more frequently. Since the probability of “knock-in” is relatively small due to the high percentage, it’s fair that brokers operate in this way.

Analyze based on different situations

No knock-in/out event

In this situation, it means that the underlying asset price stays within the range throughout the whole period. In this case, investors gain = notional * 120% (let’s take 20% for the coupon rate).

Since the underlying asset price does not fluctuate much, brokers have fewer opportunities to buy low and sell high. At the same time, brokers need to pay coupons to investors, resulting in a loss.

Investor Gain, broker loss

No Knock-in, only Knock-out

In this situation, it means that the underlying asset price rises a lot. For the brokers, they originally hold this underlying asset, so they gain a lot from this long position. Even though the broker needs to give the coupon to the investors, since they gain a lot from the underlying asset, they still win big. Gain for the brokers = Gain from holding long position of underlying asset - coupon amount.

For the investor, since it’s a knock-out, the contract is terminated, and they receive the coupon. Gain for the investor = notional price + notional price * coupon rate * (time/year), but compared to the No knock-in/out event situation, gain is relatively small. Investors need to find another investment opportunity.

Broker big gain, investor small gain

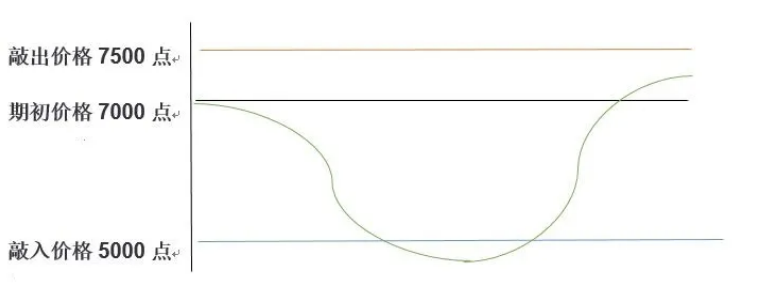

Knock-in, but knock-in < initial price < price < knock-out at the last observation time

A knock-in occurs in the observation period, but the last price is above the knock-in price and below the knock-out price, so the investor has no gain. Investor gain/loss in money = 0, but there is a loss in time value.

For the broker, as the price fluctuates between 7000 to 4900, they may buy the underlying asset at a low price (as they put a long position). As the asset rebounds to a price in the 7xxx range, there is a huge profit gained from selling high in this situation. Even if the broker doesn’t continuously buy when the price is low, they still gain from 7xxx-7000. So the gain = profit gain from buying low, selling high + (final price - initial price). The broker gains a profit and doesn’t need to pay anything to the investor.

Broker gain, investor loss in time value

Knock-in, but knock-in < knock-out < final price at the last observation time (knock-out at the end)

Investor gain = notional + notional * coupon * (time)

Same as the last situation, brokers would buy low and sell high, so they can earn a lot from this fluctuation. Gain = profit from buy low and sell high - coupon amount

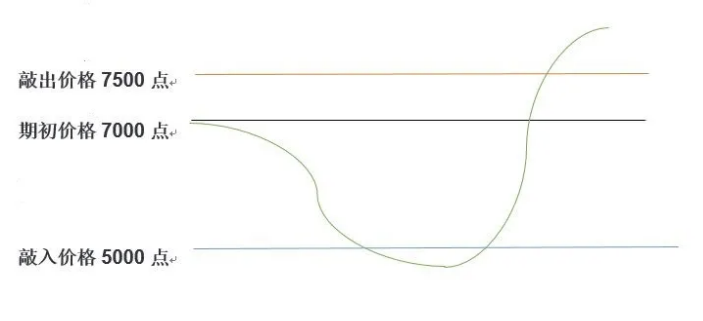

Knock-in, but knock-in < final price < initial price < knock-out at the last observation time

Investor loss = (final price - initial price) / initial price * notional

Brokers can earn a small profit from buying low at a low price and selling high afterward. Broker gain = profit from buying low, selling high + investor loss

Knock-in, Knock-in at the last observation time

Investor loss = (initial price - final price) / initial price * notional

For the broker, even though they buy a lot of underlying assets at a low price and make a loss, during this situation, all the loss is covered by the investor.

Profit from Backwardation

For the Snowball product, the underlying asset relies on CSI 500 and CSI 1000, but brokers would use the CSI 500/CSI 1000 commodity to do hedging. In the China market, there are price differences between commodities and the actual asset price, especially in CSI 500 and CSI 1000. In this case, the broker can earn much profit from it.

For example, currently, the CSI 1000 initial price is 1000, and the CSI 1000 commodity price is 800. If the ‘Knock-out’ event is triggered at the expiration date as the CSI 1000 price is at 1100, then the broker can get the underlying asset from the commodity expiration date, gaining = 1100-800=300, plus some leverage, then the broker can still have more profit after paying the coupon to the investor.

If the ‘Knock-in’ event is triggered at the expiration date as the CSI 1000 price is at 700. In this situation, the broker’s loss = 800-700=100, the investor’s loss = 1000-700=300, the loss from the investor can cover the loss from the broker, and the broker can still earn 200 in this case.

Overall, the Snowball product poses a high risk for the investor, as there is no loss protection if the underlying asset price decreases, while there is a profit limit as the underlying asset price increases. However, the broker only incurs a loss when there is not too much fluctuation in price.

Reference

finance — Jan 30, 2024

Search

Made with ❤ and at Earth.