China's Special Sovereign Bond Auction

Date : May 17

Introduction:

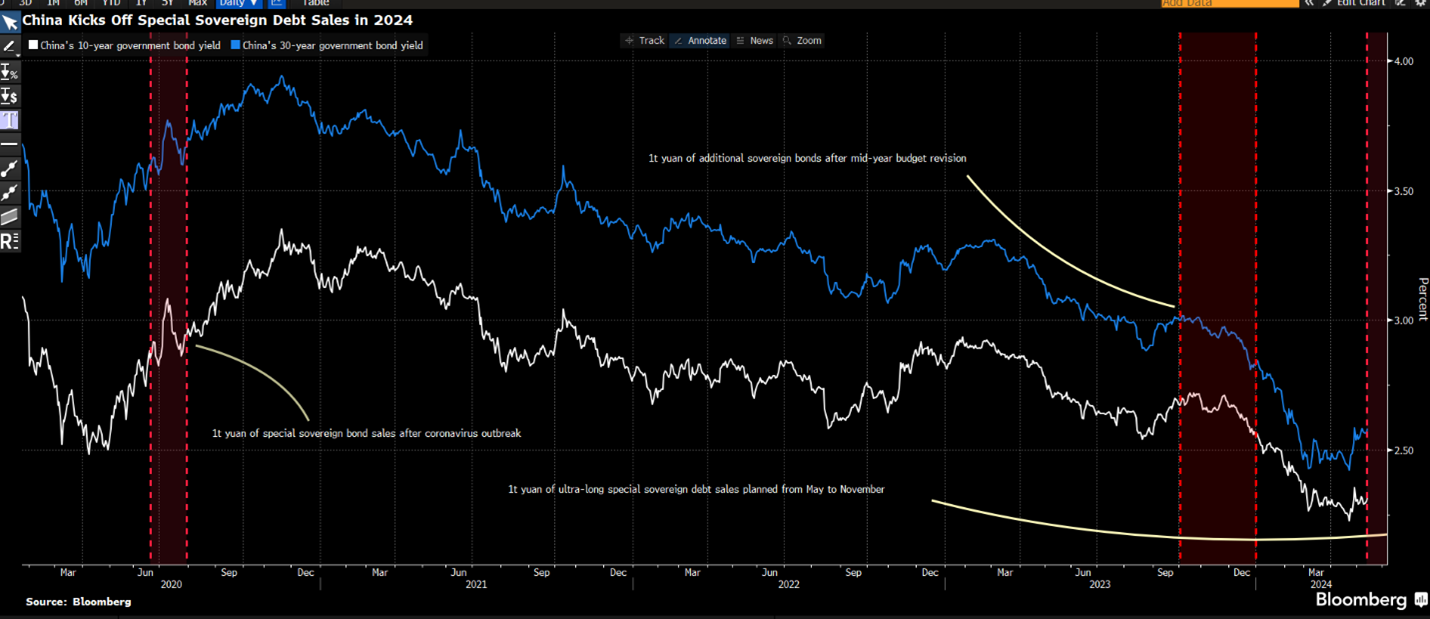

China recently conducted a highly anticipated auction for its 30-year sovereign bond, which attracted strong demand from investors. This unique issuance of long-term bonds serves a specific purpose and indicates a shift in the country’s economic strategy. The bond auction took place on May 17, with an issuance of 40 billion yuan at a yield of 2.57%. In this article, we delve into the reasons behind issuing this long-term sovereign bond, its significance, and the potential implications for China’s economic future.

Supporting Government Spending:

The primary objective of the 30-year sovereign bond issuance was to provide funding for government spending to ensure to met the GDP target (5%). China aims to address the challenges faced by local governments struggling with a debt hangover and declining income due to the ongoing property crisis.

As traditional sources of support for local governments diminish, Beijing has stepped in to provide the necessary backing through this bond issuance.

A Special Bond:

What sets this long-term sovereign bond apart is its exclusion from the country’s deficit calculations. Unlike previous bonds issued to fill the spending gap in the budget, these bonds are approved on an ad hoc basis. This marks the fourth instance of issuing special bonds in China’s history:

- during the Asian financial crisis in 1997-1998,

- when the state-owned sovereign wealth fund was established in 2007, and

- amid the pandemic in 2020 to assist local governments in combating the spread of the virus.

All the previous bond have one special objective to serve / or respond to a specific emergencies. However, the special bond released in this year is more focus on the general purpose - support economy through government spending in infrastructure as the economy growth engine.

A Potential Shift in Strategy - Possible to increase the frequency to issue special bond:

In the past, to accelerate growth, each provinces or regions would release debt by themselves, however, based on the current property issue, reducing government income and also previous unpaid debt for local government, local government would suffer from high debt pressure and may not have enough ability to support large government spending.

However, in recent years, China’s top leaders have signaled a departure from the old playbook of burdening local governments with debt to stimulate growth. Instead, they are focusing on risk management and reining in potential financial vulnerabilities. The central bank would issue the debt, and control the risk (since the central bank have much healthier balance sheet )

If downward pressure on the economy persists, the issuance of special bonds may continue to support growth in the future.

Exclusion from Deficit Calculations:

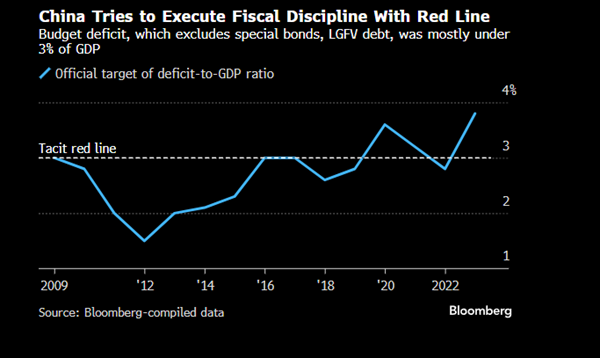

One significant aspect of this special bond is that it does not contribute to the deficit on the government’s balance sheet. Previously, the Chinese government had aimed to control the deficit rate at 3%.

However, starting from 2023, the deficit rate increased to 3.8%. Many economists view this shift as a step in the right direction, as it allows for greater flexibility in managing fiscal policy, to simulate growth.

Market Response and Implications:

The strong demand for China’s ultra long-term government bonds reflects investors’ concerns about the nation’s long-term growth prospects and a lack of appetite for risk assets. The bond auction’s cover ratio and the relatively low yield accepted indicate a pessimistic sentiment among investors.

However, questions remain regarding whether this spending will be sufficient to replace the hole in demand caused by weaker spending from firms and households or if it is merely a stopgap measure :

- The decrease in household borrowing, primarily for mortgages, since 2022 and the lack of recovery in that sector are cited as factors contributing to weaker overall spending.

- Additionally, while company borrowing reached record levels, there are concerns that a portion of those loans are being used for debt refinancing or financial speculation rather than productive investments.

Reference

- Bloomberg: China’s Special Bond Sale Sees Demand In Line With 2024 Trend

- Why China Is Considering Rarely Used Special Bonds to Stimulate Its Economy

- What Is China’s $138 Billion Bond Bazooka Aiming At?

finance — Jun 4, 2024

Search

Made with ❤ and at Earth.